Improve Your Trading Abilities with Discussions on a Forex Trading Forum

Improve Your Trading Abilities with Discussions on a Forex Trading Forum

Blog Article

The Relevance of Money Exchange in Global Trade and Business

Currency exchange acts as the foundation of global trade and commerce, allowing seamless deals between varied economic climates. Its effect extends beyond mere conversions, influencing pricing methods and earnings margins that are important for businesses running worldwide. As fluctuations in currency exchange rate can position significant dangers, efficient money danger management becomes paramount for maintaining an one-upmanship. Understanding these dynamics is important, specifically in a significantly interconnected industry where geopolitical uncertainties can further complicate the landscape. What are the effects of these variables on market availability and long-term service methods?

Function of Currency Exchange

Money exchange plays an important role in helping with international trade by enabling deals between celebrations running in various money. As organizations increasingly involve in global markets, the need for efficient currency exchange devices comes to be extremely important. Currency exchange rate, which vary based upon numerous financial signs, establish the value of one money about another, affecting profession characteristics significantly.

Furthermore, money exchange alleviates dangers linked with international transactions by supplying hedging choices that safeguard against adverse currency motions. This economic tool enables companies to maintain their expenses and earnings, additionally promoting worldwide trade. In summary, the duty of money exchange is central to the functioning of international business, giving the crucial framework for cross-border purchases and sustaining economic growth worldwide.

Influence On Rates Approaches

The systems of currency exchange significantly influence rates methods for services involved in worldwide profession. When a domestic money enhances against foreign currencies, imported products might end up being less costly, permitting organizations to lower prices or enhance market competitiveness.

In addition, businesses must take into consideration the economic conditions of their target audience. Neighborhood buying power, rising cost of living rates, and currency security can determine exactly how products are valued abroad. Firms usually adopt prices techniques such as localization, where costs are tailored to every market based upon money changes and regional financial aspects. Furthermore, vibrant prices designs may be utilized to react to real-time money motions, making certain that services stay nimble and competitive.

Impact on Revenue Margins

If the worth of that currency reduces loved one to the firm's home money, the revenues recognized from sales can reduce dramatically. Alternatively, if the international currency appreciates, profit margins can boost, improving the overall financial efficiency of the business.

Additionally, businesses importing goods encounter comparable dangers. A decrease in the worth of their home currency can cause higher expenses for foreign goods, consequently squeezing earnings margins. This situation demands efficient money threat administration methods, such as hedging, to mitigate potential losses.

Moreover, the impact of currency exchange rate variations is not restricted to direct deals. It can also affect pricing approaches, competitive positioning, and general market characteristics. Firms should stay watchful in keeping track of money fads and changing their economic approaches here are the findings as necessary to safeguard their profits. In recap, understanding and managing the influence of currency exchange on profit margins is vital for organizations aiming to preserve success in the complicated landscape of worldwide trade.

Market Access and Competitiveness

Browsing the complexities of worldwide trade calls for organizations not only to manage earnings margins yet also to make certain effective market accessibility and enhance competitiveness. Money exchange plays a critical role in this context, as it directly influences a business's ability to go into brand-new markets and complete on a worldwide range.

A favorable exchange rate can lower the expense of exporting items, making items much more appealing to foreign consumers. Conversely, an unfavorable price can blow up rates, impeding market infiltration. Firms should strategically handle currency variations to enhance prices methods and remain affordable against local and international players.

In addition, organizations that properly use currency exchange can develop chances for diversity in markets with favorable problems. By establishing a solid presence in several currencies, companies can mitigate risks connected with reliance on a solitary market. forex trading forum. This multi-currency method not only boosts competitiveness but likewise cultivates strength despite economic changes

Threats and Difficulties in Exchange

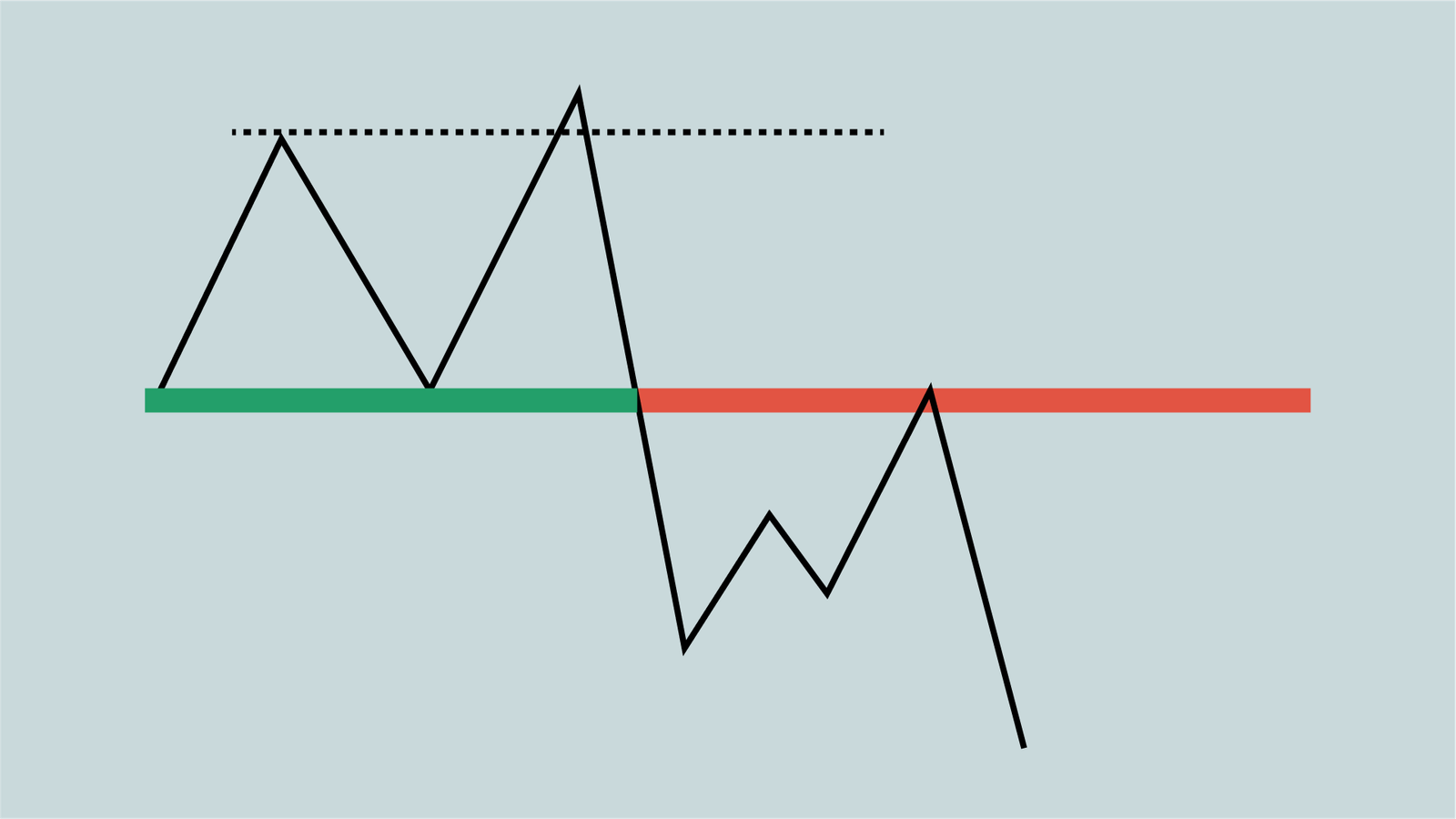

In the world of worldwide trade, companies go to the website face substantial threats and difficulties connected with currency exchange that can influence their economic stability and operational approaches. One of the main threats is exchange rate volatility, which can cause unexpected losses when transforming money. Fluctuations in currency exchange rate can affect earnings margins, especially for companies taken part in import and export tasks.

In addition, geopolitical factors, such as political instability and regulatory adjustments, can aggravate currency threats. These components might cause sudden changes in currency worths, making complex economic forecasting and preparation. Furthermore, services should browse the complexities of international exchange markets, which can be influenced by macroeconomic signs and market belief.

Verdict

Finally, money exchange acts as a cornerstone of international profession and business, helping with deals and enhancing market liquidity. Its influence on rates approaches and profit margins underscores the requirement for reliable money danger monitoring. The ability to browse market access and competition is extremely important for services operating go right here internationally. Regardless of intrinsic threats and difficulties related to changing currency exchange rate, the value of money exchange in fostering financial development and durability stays undeniable.

Report this page